Preparing for the coming

small-cap rotation to quality

January 2026

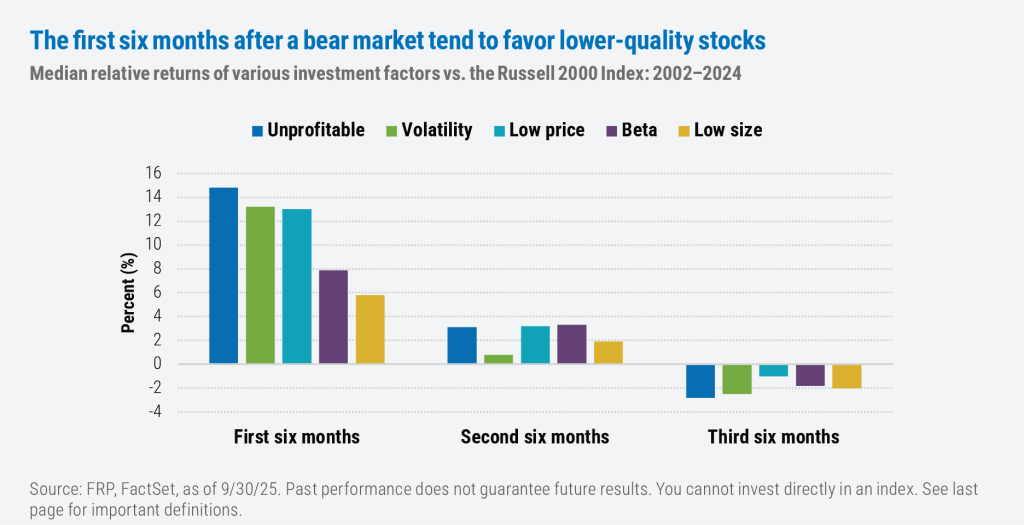

What turned out to be a good year for stocks didn’t begin that way. U.S. equities of all stripes were already repricing off of their February highs when President Trump unveiled his “Liberation Day” tariff program on April 2—and the general consensus from investors was that the net effects economically would fall somewhere between merely detrimental and outright disastrous. The selloff accelerated and the result was an official bear market for small caps between February and April, with a more-than 20% draw down in just seven weeks.

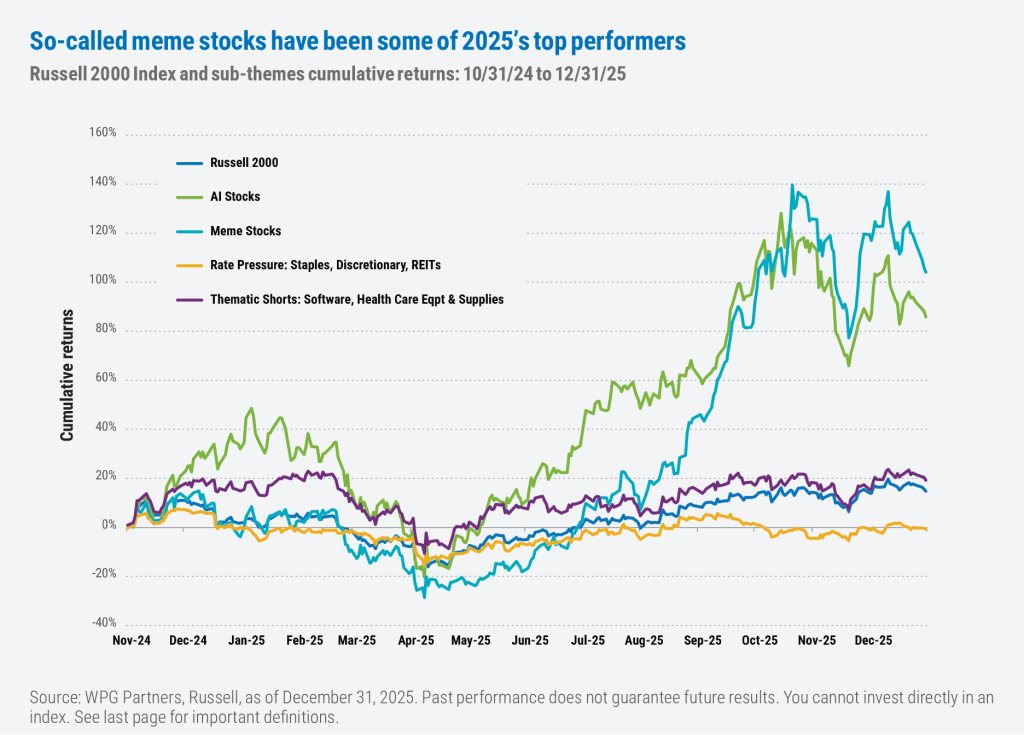

Since then, small caps have recovered handily, but the solid headline performance masks a more complicated picture when parsing the market leaders and laggards. The best performing stocks since April have been, by any of a number of reasonable measures, those of some of the lowest-quality companies. There are exceptions, as two classes of companies have performed well this year for justifi able reasons: those linked to the burgeoning build-out of artifi cial intelligence (AI) capabilities and those companies involved in the growing adoption of GLP-1 therapeutics. But among 2025’s leading performers are what we’d broadly classify as “meme stocks”—securities of companies that generate no profits (and occasionally little to no revenue) that nonetheless traded higher based almost solely on the basis of hoped-for future growth.

This phenomenon has created a challenge for active managers, particularly in environments like 2025, and navigating it presents two broad options. The first is to try to adhere relatively closely to the benchmark, which lately requires owning stocks that are fundamentally weak, in order to hedge relative risk. The problem with such a tactic—beyond the inherent compromising of investment principles—is that there’s no telling when the bottom will fall out on those momentum-based holdings; a move designed to mitigate risk could in actuality court more of it.

The second option is for active managers to stick with their investment philosophies, knowing that doing so might result in short-term underperformance, but believing that proactively positioning for a market rotation to higher quality names is the better move over the long term.

Given those two choices, it’s not much of a contest, in our view. We believe that as the current market concentration evaporates, companies with improving capital structures, cyclical tailwinds, and positive fundamental catalysts will be better positioned to generate long-term alpha.

Small caps currently offer a compelling entry point for a long-term allocation

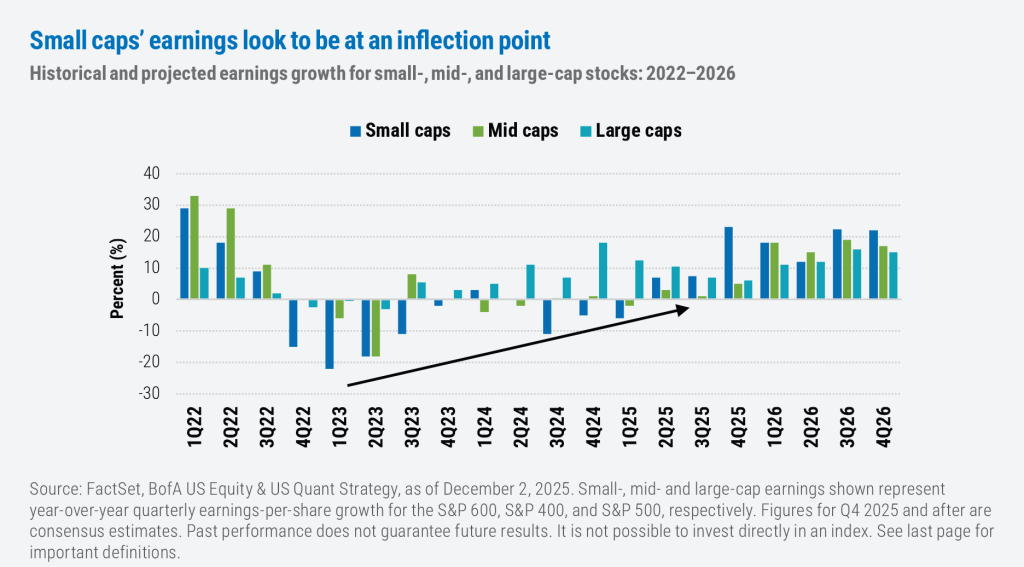

Tactical opportunities: Short-term inflection points

- More rate cuts in 2026. Fed Funds futures are currently pricing in a roughly 75% chance of at least two more rate cuts from the Fed in 2026. While the neutral policy rate appears likely to settle around 3%, the ease in policy should continue to bolster economic activity.

- An uptick in housing. Existing home sales are at cycle lows, similar to levels not seen since the fi nancial crisis. An increase in inventory and/or a drop in prevailing mortgage rates may boost industrial activity while also supporting consumer sentiment.

- Increase in durable goods purchases. A fundamental recovery could be accompanied by a recovery in consumer sentiment. This would support spending, particularly from lower income cohorts.

Strategic opportunities: Longer-term durable trends

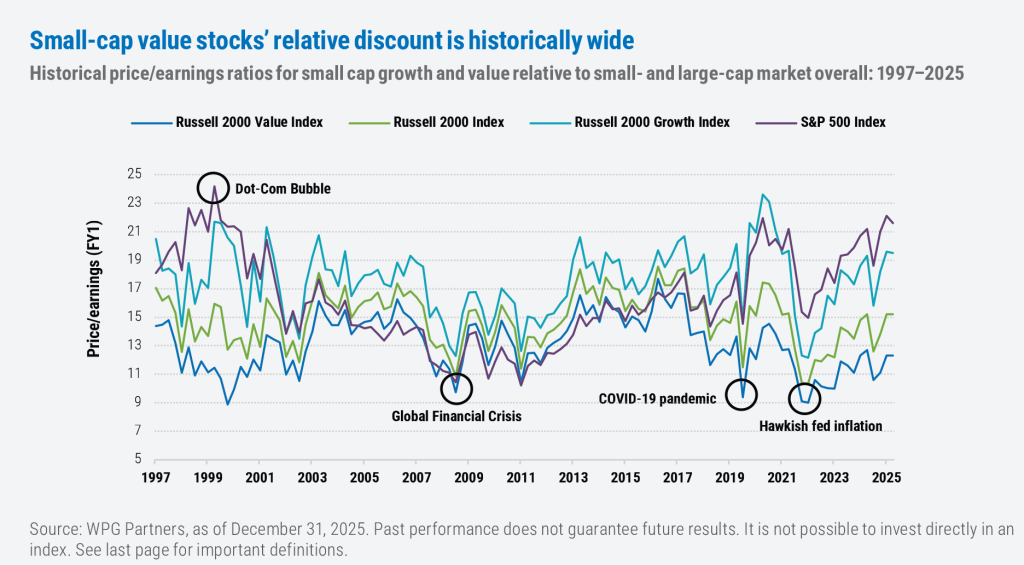

- Attractive relative valuation. By almost any measure, small caps look cheap and are hovering near cycle lows. The valuations are even more compelling when compared to other market segments like the S&P 500.

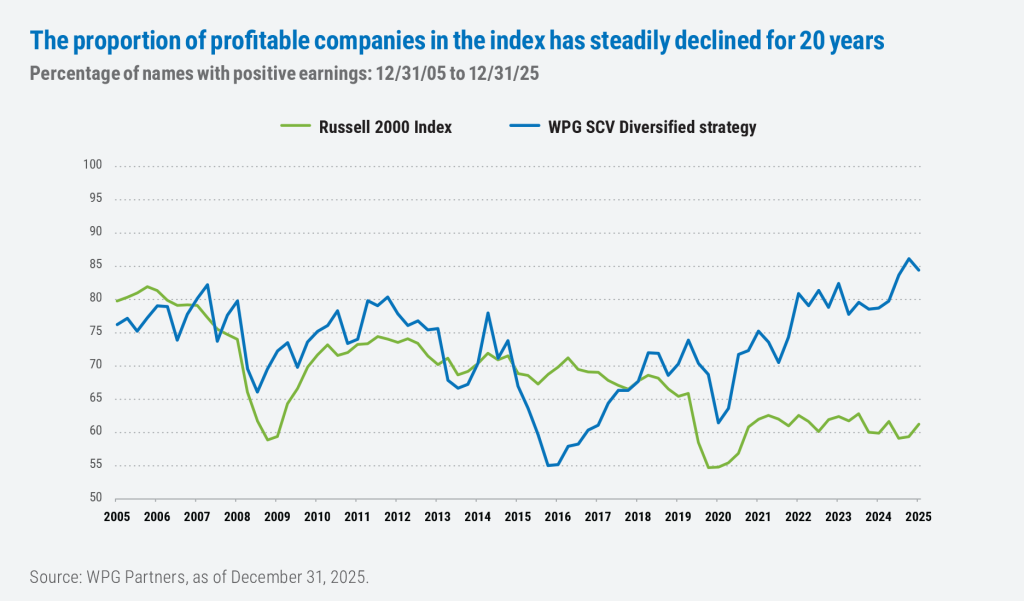

- Positive real rates: While short-term rates appear poised to fall somewhat further, we believe the fl oor will be meaningfully higher than in past cutting cycle. In other words, we’re unlikely to return to a zero interest rate environment. That is signifi cant because growth stocks won’t have the same valuation buoy as they did in the wake of the Global Financial Crisis—negative real interest rates pushed investors into other asset classes, including stocks. We believe the market will pay more attention to fundamental measures like earnings and cash flow.

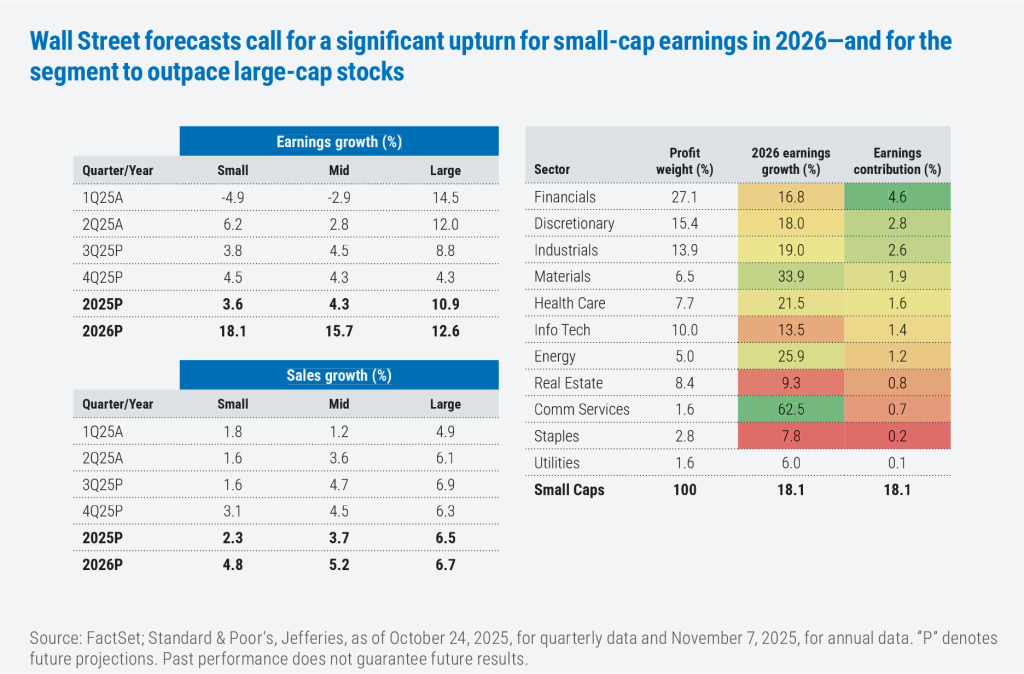

Cyclical sectors are poised to benefit from these dynamics

Looking at small caps from a sector-level perspective, while Financials look particularly well positioned to benefit from current market dynamics, we see evidence that higher returns on equity can be sustained through the next leg of the small-cap recovery cycle, as the era of zero interest rate policy (ZIRP) continues to recede into the past. That reality should act as a tailwind for multiple areas of the market.

- Banks stand to continue to benefi t from higher lending margins

- Industrials are experiencing productivity gains through domestic reindustrialization and the integration of artifi cial intelligence

- Materials are poised to recover amid China’s policy shift away from involution

- Consumer sectors stand to gain from anticipated reductions in short-term interest rates.

Conclusion

Important disclosures

The views expressed in this commentary refl ect those of the author as of the date of this commentary. Any such views are subject to change at any time based on market and other conditions and Boston Partners disclaims any responsibility to update such views. Past performance is not an indication of future results.

Discussions of securities, market returns, and trends are not intended to be a forecast of future events or returns. You should not assume that investments in the securities identified and discussed were or will be profitable.

Terms and definitions

AI Stocks are represented by companies in the Russell 2000 Semiconductors & Semiconductor Equipment industries and by the following AI-related companies: Applied Digital Corp., Bit Digital Inc., Chaince Digital Holdings, Cerence Inc. Palladyne AI Corp, Core Scientifi c, BiGBear.ai, and Fluence Energy. Meme Stocks are represented by companies in the Russell 2000 Bitcoin mining, nuclear energy, satellite, and quantum computing fields, specifically by the following companies: EchoStar Corp., Oklo Inc., Coeur Mining Inc., Hecla Mining Co., Viasat Inc., Cipher Mining, SSR Mining Inc., Hut 8 Corp., and Cleanspark Inc. Rate Pressure stocks are represented by companies in the Russell 2000 Consumer Discretionary, Consumer Staples, and REITs sectors. Thematic Shorts are represented by companies in the Russell 2000 Software and Health Care Equipment & Supplies industries. All weights for sectors, industries, and individual stocks are proportional to their representation in the Russell 2000 Index.

Alpha measures the excess risk-adjusted return of a portfolio relative to a benchmark index. EBITDA stands for earnings before interest, taxes, depreciation, and amortization. It is used to evaluate a company’s profitability from core business operations, excluding the effects of any accounting practices. Enterprise value is a measure of a company’s total value, including its market capitalization, total debt, and preferred equity, minus any cash and cash equivalents. Investment factors can refer to any number of measurable characteristics that may explain differences in securities’ risk and return over time. Common factors include size, price, profitability, value, momentum, quality, and volatility (e.g., beta). Price/earnings (P/E) ratio measures a company’s current share price compared to its per-share earnings. The Russell 2000 Index tracks the performance of 2,000 of the smallest companies traded in the United States. The Russell 2000 Growth and Value Indexes track the performance of those small-cap U.S. equities in the Russell 2000 Index with growth and value style characteristics, respectively. The S&P 500 Index tracks the performance of the 500 largest companies traded in the United States. The S&P 400 and 600 Indexes track the performance of the 400 mid-cap and 600 small-cap companies, respectively, traded in the United States. You cannot invest directly in an index.

Boston Partners Global Investors, Inc. (Boston Partners) is composed of three divisions, Boston Partners, Boston Partners Private Wealth, and Weiss, Peck & Greer (WPG) Partners, and is an indirect, wholly owned subsidiary of ORIX Corporation of Japan (ORIX).

8718735.1

Eric Gandhi, CFA

Portfolio Manager

Emil Friis

WPG Partners Small Cap Value intern

WPG Partners Small Cap Value Diversified Fund

A more broadly-diversified portfolio of small-cap stocks built on WPG’s time-tested approach.

WPG Select Small Cap Value

A concentrated portfolio of our highest-conviction small-cap ideas managed by the veteran team at WPG Partners.