Casting a wider net: why European

industrials may deserve a closer look

October 2025

Lofty valuations in U.S. equities are no reason to head for the sidelines. Our team sees ample opportunities in a number of segments of the international market, especially in Europe.

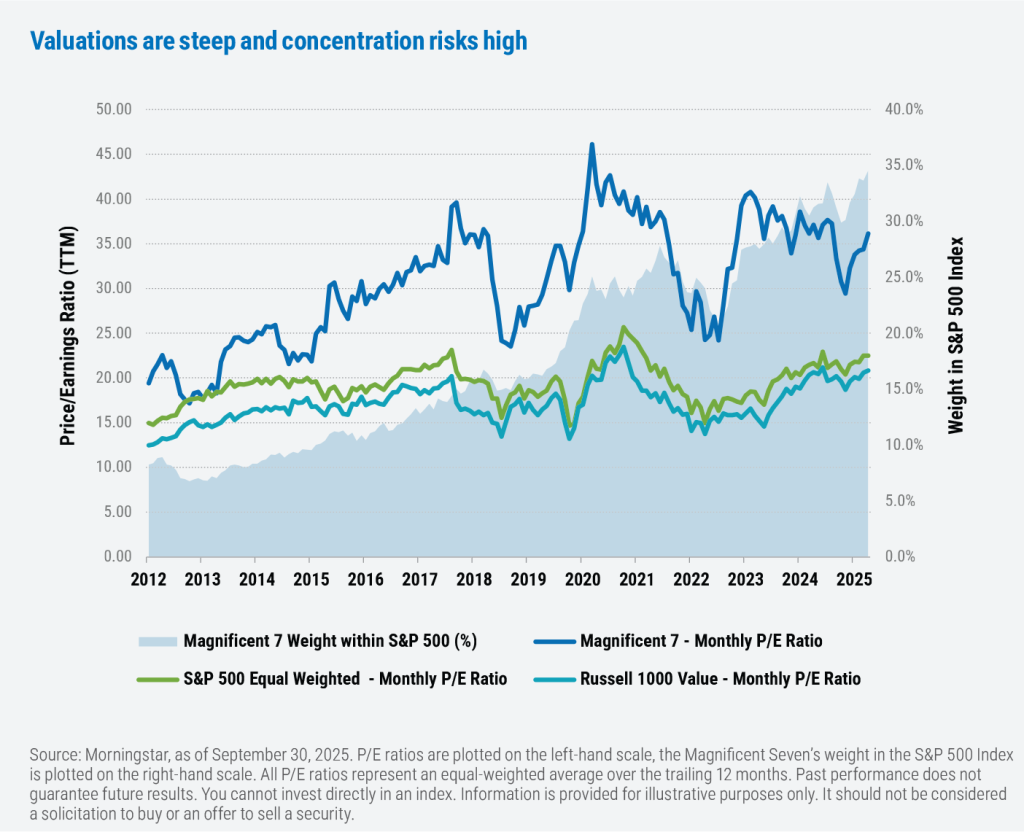

The dominant role of the so-called Magnificent Seven stocks (Alphabet, Amazon, Apple, Meta Platforms, Microsoft, Nvidia, and Tesla) within U.S. core indexes has been well documented in recent months. In just 10 years, the seven stocks have gone from representing just over 12% of the S&P 500 Index’s market capitalization in 2015 to 34% today.1 That disproportionate representation has led to something of a feedback loop, in which the returns for the broad U.S. stock market have tended to be a reflection of the performance of the Mag 7 themselves.

Big Tech is both expensive and capital intensive

The issue of concentration risk is compounded by the fact that valuations for the Mag 7 are still quite high—currently more than 30 times earnings. That’s considerably higher than the roughly 20x trailing P/E ratios of both the Equal Weighted S&P 500 and the Russell 1000 Value Index. Such lofty multiples for Big Tech stocks imply equally lofty expectations: Any weakness in earnings or growth may translate into a swift repricing for the segment, as evidenced in April 2025

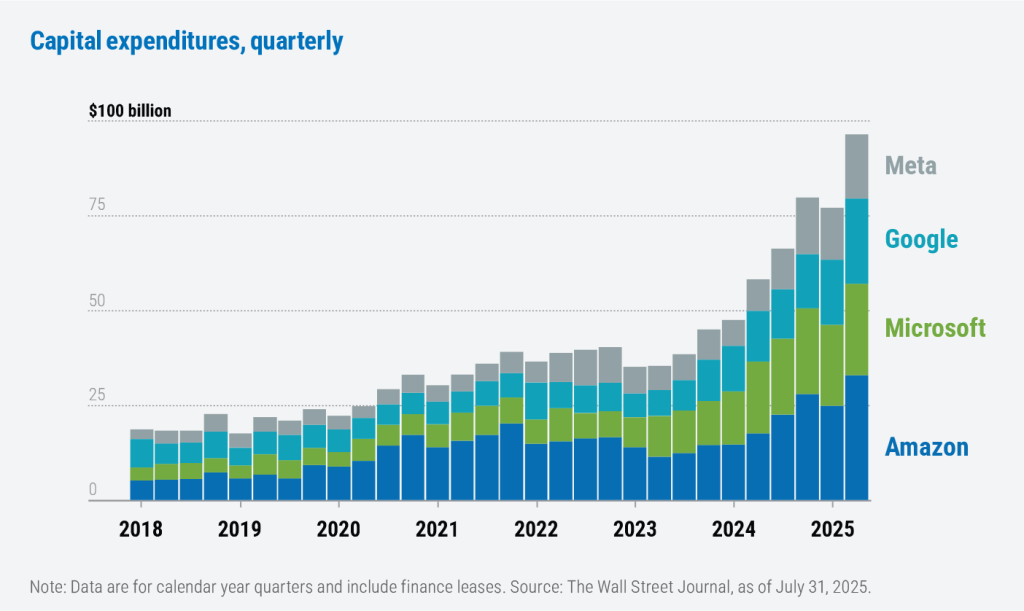

The other wildcard worth watching is spending. Capital expenditures—specifically on artificial intelligence (AI) related investments—have grown dramatically for large technology companies in a relatively short period of time. The return on these significant investments remains to be seen—as does the persistence of investor patience in waiting for those returns.

Cast a wider net to find better valuations

Our Three Circle investment approach seeks to identify fundamentally solid companies that are trading at attractive valuations and experiencing positive business momentum. Despite the current challenges in the U.S. equity market (where valuations in many segments are above historical norms), we’ve been finding no shortage of quality companies overseas that meet our criteria—particularly in European industrials.

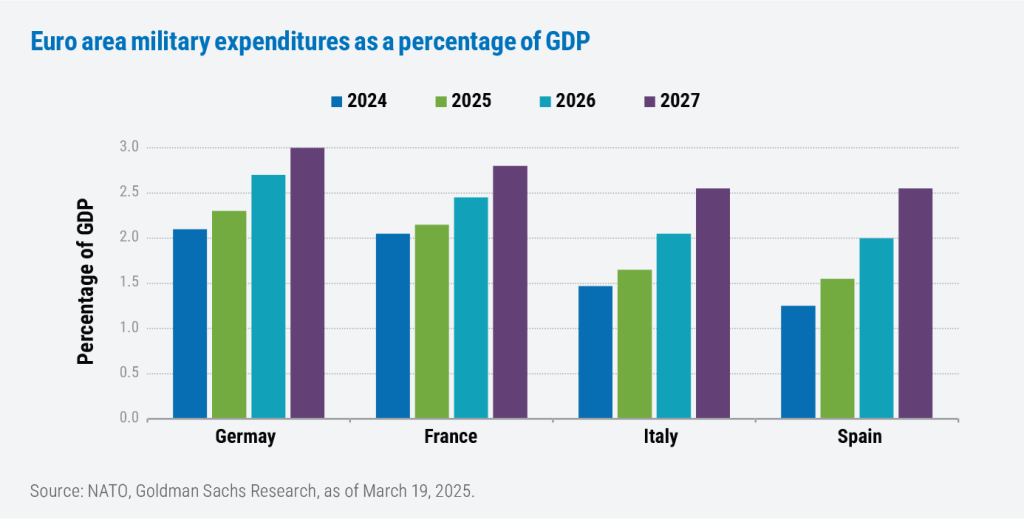

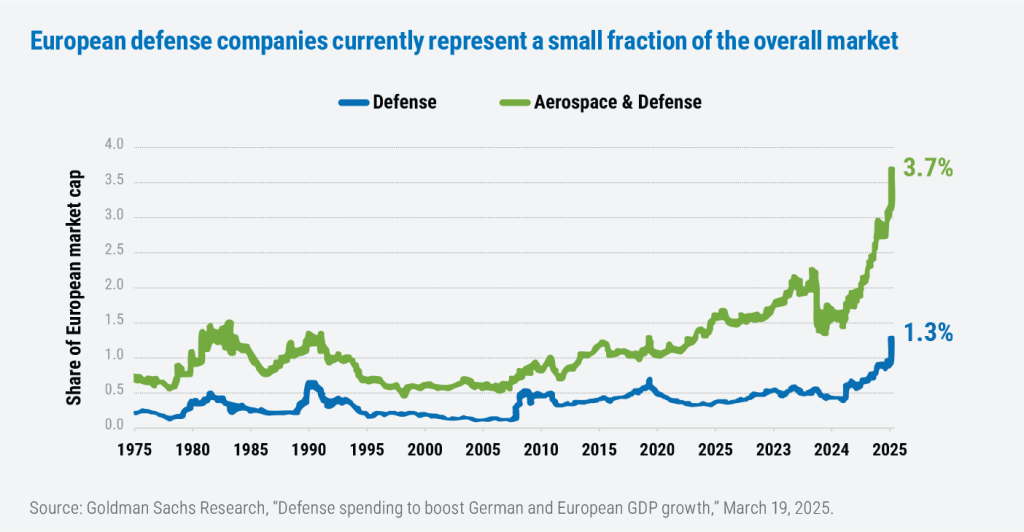

We believe the European industrials sector today sits at the intersection of several powerful global trends, from new government spending initiatives to structural shifts in technology and supply chains. This is especially true within the aerospace and defense segment, where higher defense spending intentions and rising infrastructure stimulus are expected to provide a substantial boost. With European and Canadian NATO outlays expected to rise from 1.7% of GDP in 2022 and 2.0% in 2024 to a pledged 3.5% on “core defense requirements” by 2035, the growth runway is significant.2 In addition, a greater allocation of spending toward European-made equipment should help buttress regional manufacturers and create more durable long-term demand across the continent.

Meanwhile, Germany’s announcement of a €1 trillion spending initiative marks a historic departure from its traditional fiscal conservatism and highlights how political consensus is shifting.3 Similar trends are emerging in the United Kingdom and France, where bipartisan support is coalescing around investment in infrastructure, defense, and green technologies. This pivot in public policy represents a powerful tailwind for industrials more broadly given the newfound financial backstop for multi-year projects that require capital goods, engineering services, and construction-related activities.

The AI rollout is boosting both supply and demand for industrials companies

Beyond defense and infrastructure spending, the electrical equipment industry in Europe is also benefiting from transformative demand drivers. The global buildout of AI data centers is accelerating the need for advanced electrical systems, while the transition to new energy solutions—from renewable integration to grid modernization—is providing an additional layer of durable growth.

These trends are creating opportunities for companies that can supply high-efficiency power solutions, advanced components, and more modern technologies.

At the same time, automation and AI tools are reshaping how industrials businesses operate. Companies that are deploying advanced automation tools, AI-driven process optimization, and digital supply chain management solutions are gaining measurable efficiency advantages: These innovations streamline workflows, reduce administrative burdens, and improve both operating margins and global competitiveness.

Resilient global trade, increased investment, and good capital discipline all act as additional tailwinds for the sector

Growth in the Industrials space doesn’t occur in a vacuum: The sector remains deeply linked to global trade, capital investment, and infrastructure activity—areas that tend to accelerate during periods of macroeconomic strength. We believe this cyclical sensitivity, when paired with long-term secular tailwinds, positions the sector well for both near- and medium-term growth. Supply chain

reshoring initiatives, the ongoing energy transition, and a steady pace of efficiency improvements are reinforcing the underlying strength of the sector. That said, U.S. trade and tariff policies remain an area worth monitoring closely, but the data so far suggests that global trade has been weathering the increased cost of doing business with the United States.4

Finally, an important differentiator within industrials lies in capital efficiency. We look for companies that consistently deliver high returns on invested capital (ROIC), which—when coupled with healthy balance sheets and robust cash flow generation—not only lends financial resilience during downturns, but also allows for organic investment, attractive shareholder returns, and accretive acquisitions.

Conclusion

Taken together, for investors concerned about mounting concentration risk in U.S. equities, these dynamics paint a constructive picture for the European industrials sector. Given the structural growth opportunities in defense and energy infrastructure—paired with disciplined capital allocation and potential efficiency gains from automation—we believe European industrials offer underappreciated upside potential at attractive absolute valuations.

Important information

The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. Price/earnings (P/E) ratio measures a company’s current share price compared to its per-share earnings. Trailing P/E includes earnings over the past 12 months. Return on Invested Capital (ROIC) is calculated by dividing a company’s net operating profit by its invested capital, and measures how efficiently a company uses capital to generate profits. The Russell 1000 Value Index tracks the performance of those large-cap U.S. equities in the Russell 1000 Index with value style characteristics. The S&P 500 Index tracks the performance of the 500 largest companies traded in the United States. The S&P 500 Equal Weight Index also tracks the performance of the 500 largest companies traded in the United States, but weights each company equally, rather than proportionally according to market cap. It is not possible to invest directly in an index.

Boston Partners Global Investors, Inc. (Boston Partners) is composed of three divisions, Boston Partners, Boston Partners Private Wealth, and Weiss, Peck & Greer (WPG) Partners, and is an indirect, wholly owned subsidiary of ORIX Corporation of Japan (ORIX).

Investment risks

Diversification does not guarantee a profit or protect against a loss in declining markets. It is a strategy designed to help manage risk. While diversification can help reduce the impact of volatility on your portfolio, all investments carry some level of risk, including the potential loss of principal.

Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; value stocks may decline in price; growth stocks may be more susceptible to earnings disappointments; the securities of small companies are subject to higher volatility than those of larger, more established companies. This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise.

Boston Partners Global Investors, Inc. (Boston Partners) is an Investment Adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. Boston Partners is an indirect, wholly owned subsidiary of ORIX Corporation of Japan. Boston Partners updated its firm description as of November 2018 to reflect changes in its divisional structure. Boston Partners is comprised of two divisions, Boston Partners and Weiss, Peck & Greer Partners.

Securities offered through Boston Partners Securities, LLC, an affiliate of Boston Partners.

8460393.1

International Equity

A strategy seeking attractively priced opportunities outside the United States.

International Select

A concentrated portfolio of our highest-conviction international opportunities.