How long/short investing can turn volatility into a positive in turbulent markets

May 2025

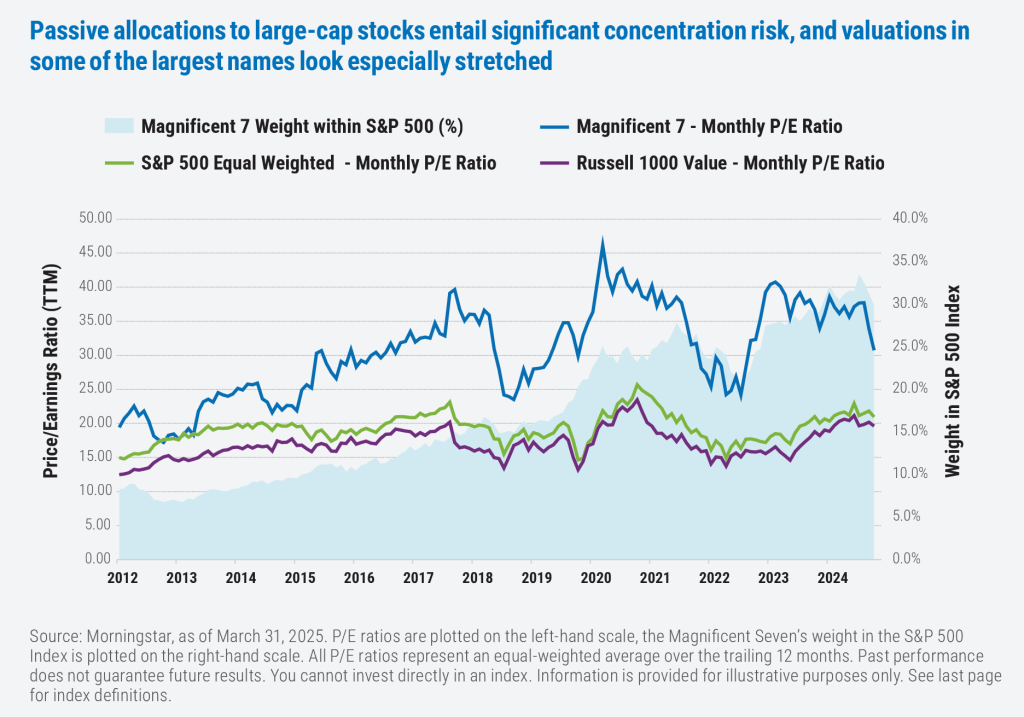

For more than two years, equity market performance in the United States has been driven by an unusually small number of high-flying tech stocks—the so-called Magnificent Seven. One result of that lopsided performance has been the nearly unprecedented concentration risk the market now entails: The Mag 7 today make up almost 30% of the S&P 500 Index and more than half the Russell 1000 Growth Index.

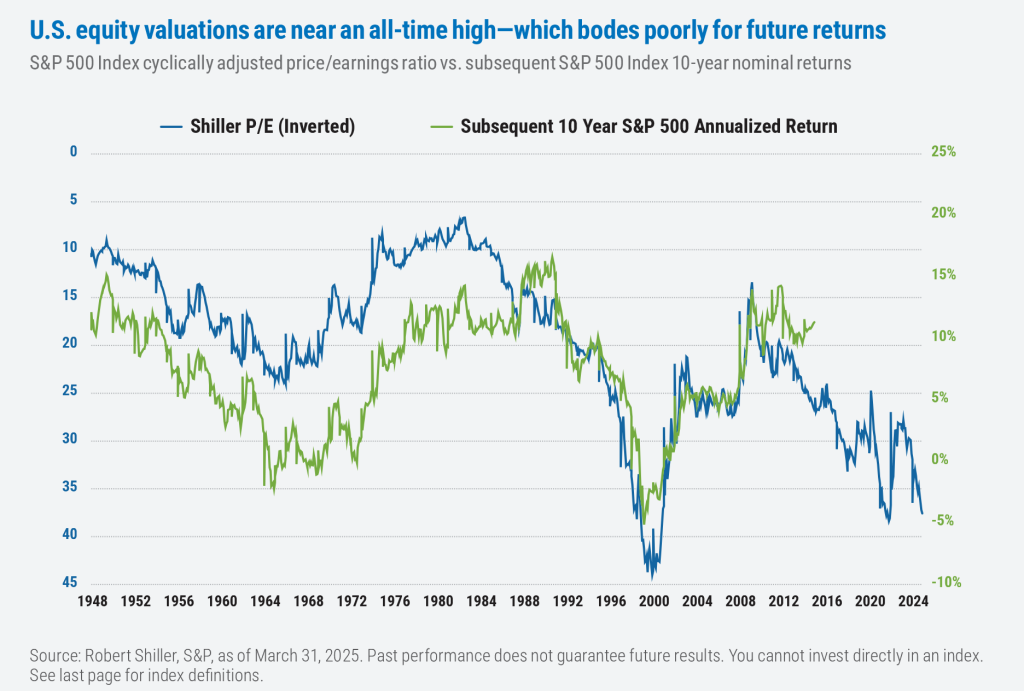

It’s no secret that this unusual level of concentration risk means a downturn in the tech sector or disappointing earnings results for just a handful of companies would have severe implications for investors—particularly those with allocations designed to track the S&P 500 or with growth-oriented positions. With large parts of the market looking fully valued, there isn’t a lot of opportunity in prices to absorb any bad news—and signs of trouble are already emerging.

The economic soft landing investors are hoping for may be bumpier than expected

President Trump promised new rounds of tariffs if elected and, for better or worse, that moment has arrived. Tensions with trading partners have increased and retaliatory tariffs have been enacted, with the economic consequences hard to predict. The Federal Reserve, sensing renewed inflationary pressures since December, has paused on its attempts to lower interest rates. Companies are announcing layoffs at an accelerating pace, consumer confidence has continued to trend down, and GDP in Q1 contracted by 0.3%, the first decline since 2022. If broad economic conditions continue to deteriorate—or even if they remain in their current state—it becomes increasingly hard to see how the stellar returns for the stock market over the past two years could repeat themselves for a third time in a row. (The S&P 500 Index gained 26% in 2023 and 25% in 2024.) Investors would be wise to ask themselves now whether their portfolios are positioned to endure increased volatility in the markets, as that turbulence may have already returned to the market and could persist for some time.

Long/short investing can help in markets like these

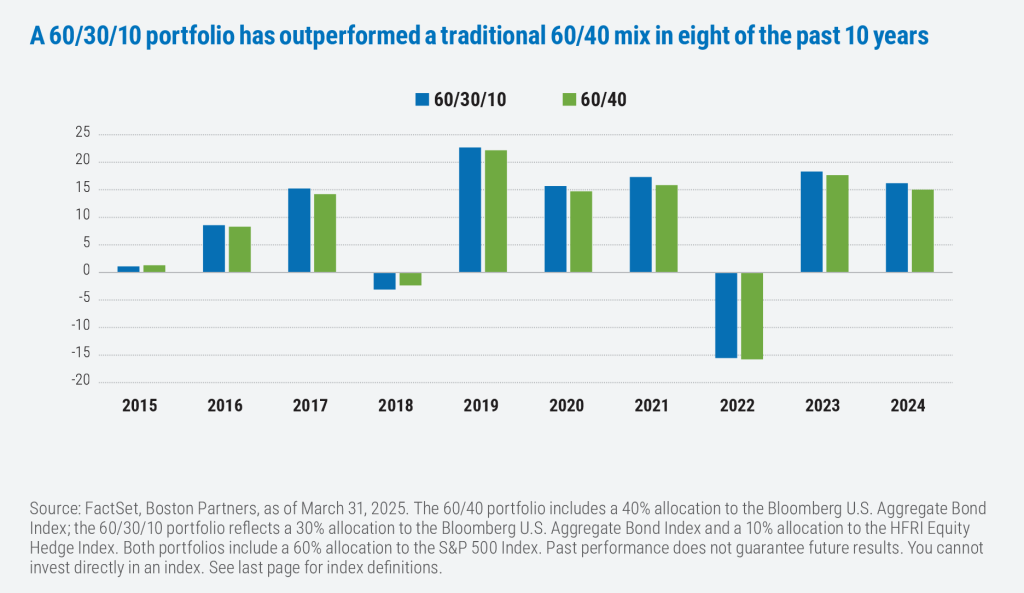

While there are no guarantees when it comes to investing, maintaining a well-diversified portfolio as a general principle has rarely disappointed. One of the most foundational tactics when it comes to diversification is the idea of offsetting equity market risk by owning bonds. This time-tested strategy has much to recommend it, but it isn’t foolproof: Instead of one zigging while the other zags, stocks and bonds do occasionally move in the same direction. For example, in 2022 the S&P 500 was down just over 18%. The yield on 10-year U.S. Treasuries began that year at 1.63%, but finished at 3.88%; the Bloomberg U.S. Aggregate Bond Index finished down 13%. The good news is that there are multiple ways to achieve the goal of portfolio ballast. We’d argue one of the most effective (and underappreciated) ways of hedging against market downturns is through shorting stocks.

By way of background, shorting a stock typically means borrowing a stock from an entity that already owns it, and then selling the position based on the belief that it will be worth less in the future than it is today. If the stock does in fact depreciate, the borrower can buy it back and return the shares to the lender; the short seller’s profit is effectively the amount by which the stock declined.

Long/short strategies come in many different styles, but as a rule they all combine long and short positions in a single portfolio. Some managers will take a market-neutral approach, which aims for investor capital dedicated to the long and short portfolios to be equal; other managers will use a variable long-biased approach, wherein the manager typically maintains a larger percentage of assets on the long side of the portfolio than the short portfolio.

In general, these types of strategies can generate a positive return in any of three ways: The long positions the portfolio holds can appreciate; long positions can outperform short positions; and lastly, the proceeds from the short sales can be reinvested and earn a positive return themselves.

What happens to the proceeds from short sales can vary greatly depending on the strategy. Some reinvest the capital into the highest conviction long equity positions, effectively creating a form of leverage. Other strategies take a more conservative approach and invest the capital in highquality short-term bonds, like three-month Treasuries. In either case, the result is a portfolio that can benefit when the stock market goes up or down.

While ideally the securities a long/short strategy has shorted would go down in value (which, again, adds to total returns) while the long positions go up, it’s generally the case that a strategy will appreciate in value when its long holdings outperform its shorts.

In just about any environment, even a strong bull market, there are usually opportunities to identify securities that appear overvalued and due for a price correction—which is one key way shorting stocks can add value over time.

Higher interest rates can act as a tailwind for long/short strategies

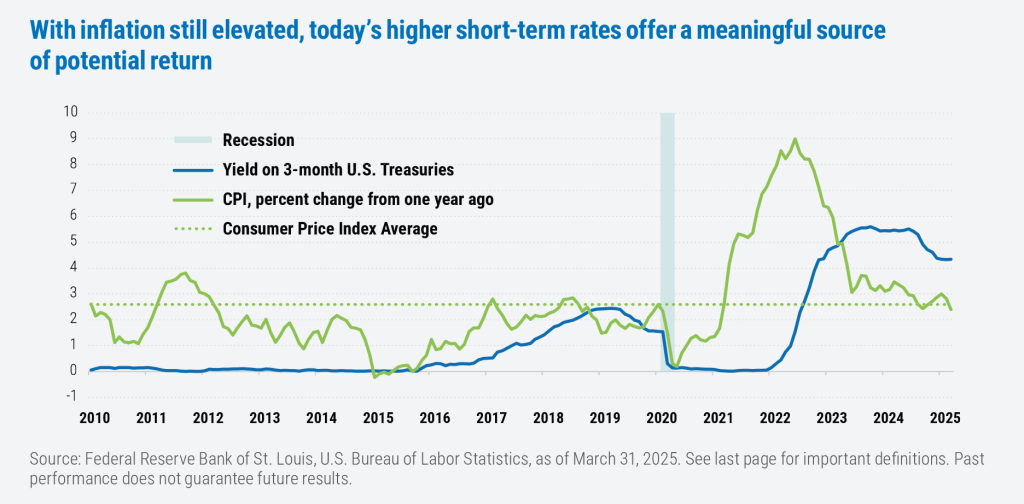

Higher interest rates are generally good news for long/short strategies for several reasons. First, all else being equal, a higher cost of capital tends to mean that financial missteps have more significant consequences for companies: An environment with a greater dispersion of returns—bigger spreads between the winners and losers—means a broader opportunity set for short portfolios.

The other reason higher rates can be helpful is that the proceeds from short sales that are invested in Treasuries can earn a higher rate of return. This was decidedly not the case during much of the period from 2009 to 2022: For much of that time, short-term rates were generally close to zero.

Higher rates also create a bigger buffer for investments that don’t pan out quite as anticipated: When a stock is shorted but actually goes up in value by, say, 3%, and those proceeds earn 4% in short-term Treasuries, that trade still represents a profit.

With inflation still proving a challenge for the Federal Reserve to rein back in to its desired level, short-term rates could remain elevated at or near their current levels for some time.

Using long/short strategies in a diversified portfolio

There are any number of ways to incorporate a long/short strategy into a diversified portfolio. Consider the typical 60/40 mix of stocks and bonds. For investors concerned about exposure to equities in the face of rising volatility, a portion of the equity sleeve could be reallocated to long/short strategies with the goal of reducing overall market exposure: a 50/40/10 mix might be one result. Conversely, investors looking for more upside potential than is typically available in high-quality fixed income might allocate some of their “defensive budget” to long/short strategies: think 60/30/10. For investors who already own a slug of alternatives—perhaps a 50/30/20 allocation—long/short strategies would be right at home within the dedicated alts sleeve.

Experience matters in uncertain markets

Long/short investing is a nuanced discipline and requires a different skill set than constructing a long-only portfolio. Companies facing headwinds or deteriorating fundamentals could be underweighted, avoided, sold, or shorted—knowing which tactic to draw on when is an ability we believe can only gained through hands-on experience.

At Boston Partners, we’ve been managing dedicated long/short strategies for over 25 years in all kinds of markets—through crises, bubbles, rebounds, and turbulence. All of our analysts have responsibility for covering short sale opportunities, identifying companies that are encountering challenges likely to result in downward pressure on their stock prices. Since our analysts have more than 12 years’ experience on average, that means 12 years of experience in covering short sales.

That level of experience plays a crucial role in our investment process given that our short portfolios target individual stocks, rather than using entire sectors or ETFs. Being able to successfully identify the factors working against individual companies within a sector or industry—and target those opportunities accordingly—allows us to take a much more tailored approach with our portfolios.

Moreover, our suite of long/short strategies don’t use leverage, either by borrowing funds outright or by doubling down on long positions. Proceeds from our short sales are typically reinvested in short-term, high-quality bonds, which earn incremental income for the portfolio. Using leverage is not in itself a detriment, in our view, but it does have the potential to add significantly to the volatility of a portfolio’s long positions. We believe that would run counter to the end-goal of a long/short portfolio, which is to offer equity-market exposure with less risk.

Conclusion

After two years of stellar performance in U.S. equities, new cracks are beginning to show in the foundation that’s supported such a rally. Fundamentals are less certain than ever given the shifting trade and tariff policies pursued by the Trump administration, and valuations by most metrics appear to be stretched to uncomfortably high levels. At Boston Partners, we believe long/short strategies were built for moments like this. With myriad varieties of long/short strategies available to investors and multiple ways to implement long/short into a diversified portfolio, we believe investors concerned about the downside risk in equities should be asking how, not whether, to work long/short strategies into their long-term allocations.

Important information

The Bloomberg U.S. Aggregate Bond Index tracks the performance of intermediate-term investment-grade bonds traded in the United States. The HFRI Equity Hedge (Total) Index tracks the performance of hedge funds employing equity hedge strategies, which typically involve taking long positions in undervalued stocks and short positions in overvalued stocks. The S&P 500 Index tracks the performance of the 500 largest companies traded in the United States. The S&P 500 Equal Weight Index also tracks the performance of the 500 largest companies traded in the United States, but weights each company equally, rather than proportionally according to market cap. It is not possible to invest directly in an index. The Shiller P/E ratio, also known as the Cyclically Adjusted Price-to-Earnings (CAPE) ratio, is a valuation measure that compares the price of a stock or index with its average inflation-adjusted earnings over the past ten years. GDPNow is a running real-time estimate of U.S. GDP growth produced by the Federal Reserve Bank of Atlanta. The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla.

Investment risks

Diversification does not guarantee a profit or protect against a loss in declining markets. It is a strategy designed to help manage risk. While diversification can help reduce the impact of volatility on your portfolio, all investments carry some level of risk, including the potential loss of principal.

Stocks and bonds can decline due to adverse issuer, market, regulatory, or economic developments; foreign investing, especially in emerging markets, has additional risks, such as currency and market volatility and political and social instability; value stocks may decline in price; growth stocks may be more susceptible to earnings disappointments; the securities of small companies are subject to higher volatility than those of larger, more established companies. This material is not intended to be, nor shall it be interpreted or construed as, a recommendation or providing advice, impartial or otherwise.

Boston Partners Global Investors, Inc. (Boston Partners) is an Investment Adviser registered with the Securities and Exchange Commission under the Investment Advisers Act of 1940. Registration does not imply a certain level of skill or training. Boston Partners is an indirect, wholly owned subsidiary of ORIX Corporation of Japan. Boston Partners updated its firm description as of November 2018 to reflect changes in its divisional structure. Boston Partners is comprised of two divisions, Boston Partners and Weiss, Peck & Greer Partners.

Securities offered through Boston Partners Securities, LLC, an affiliate of Boston Partners.

7938473.1

Long/Short Equity

Designed to offer compelling returns with less market risk, this strategy combines long and short positions in U.S. equities.

Long/Short Research

An analyst-led portfolio of the company’s highest conviction ideas, the strategy combines long and short positions to pursue competitive returns with less risk.