Long/short investing for volatile markets

A deeper dive into Boston Partners' process

In this overview, Portfolio Analyst Brandon Smith reviews how long/short portfolios work, what to look for in selecting a manager, and why they’re attractive in today’s market.

With many investors heavily exposed to just a handful of stocks, now may be the time to examine how long/short strategies can help mitigate today’s equity-market risks. Here are three key ways:

Combining long and short positions in a single diversified portfolio can help reduce volatility and potentially lead to higher compound returns.

When the stock market sells off, short positions generally appreciate, which can add ballast to a portfolio, helping to mitigate drawdowns and potentially improve risk-adjusted returns.

Short positions don’t only act as a hedge, they also represent a unique and uncorrelated source of alpha with the ability to generate positive returns in choppy or down markets.

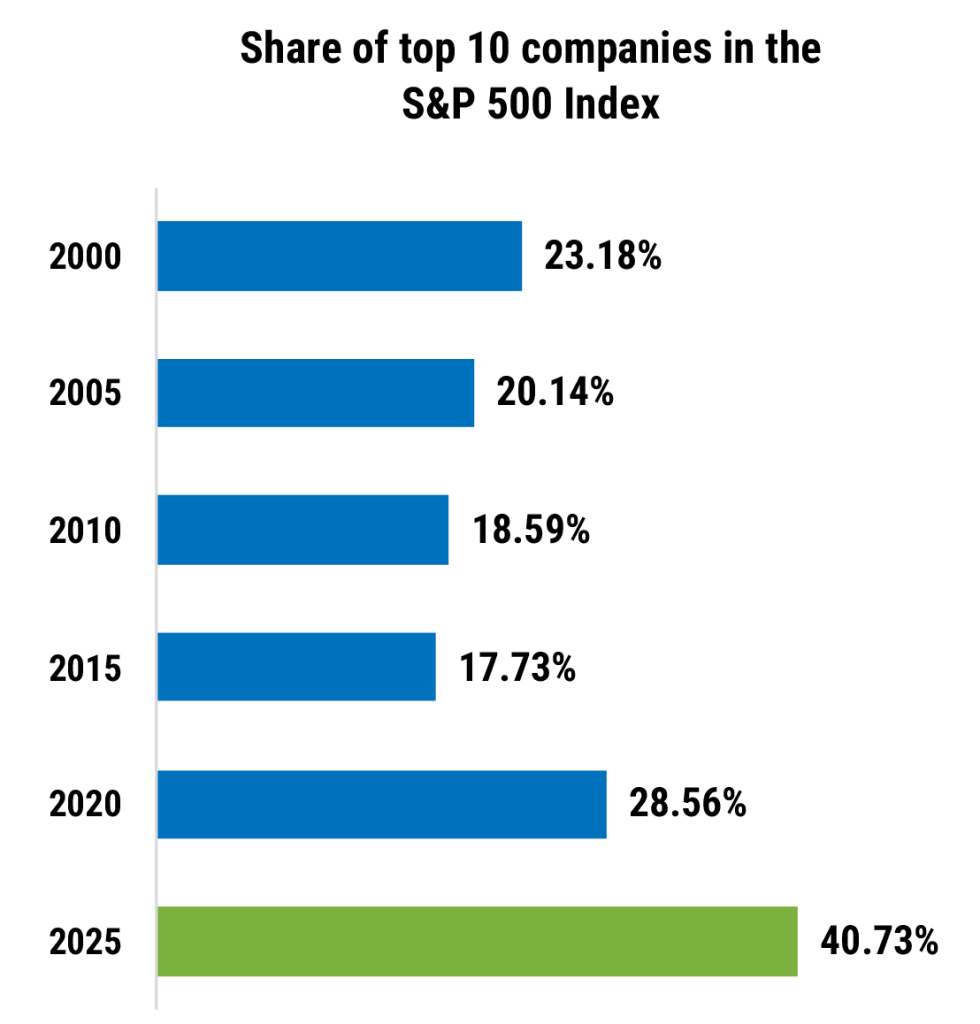

Concentration risk among large U.S. companies has reached new highs

The Magnificent Seven—a group of large, growth-oriented, tech-focused companies—were some of the stock market’s top performers over the past three years. But with valuations stretched and investors increasingly anxious about the state of the broader economy, that momentum may not continue. What worked in years past is no longer a sure thing in today’s more volatile and risk-conscious environment.

Source: Boston Partners, as of December 31, 2025. Data for top 10 companies is as of calendar year end, except for current year, which is as of the most recent quarter end. Alphabet’s two share classes are combined and considered to represent a single company. Past performance does not guarantee future results. You cannot invest directly in an index. Information is provided for illustrative purposes only. It should not be considered a solicitation to buy or an offer to sell a security.

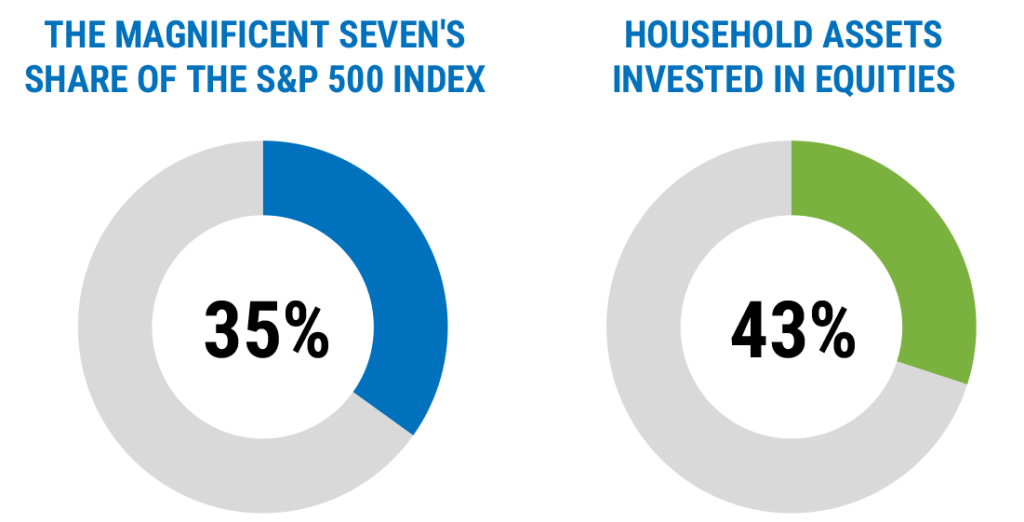

Source: Magnificent Seven via Morningstar, as of December 31, 2025; household assets via the Federal Reserve Bank of St. Louis, as of December 31, 2024 (most recent year-end data available). See other important definitions below. Past performance does not guarantee future results. You cannot invest directly in an index.

Investors are still heavily exposed to some of the most expensive and vulnerable stocks on the market

After a streak of strong returns, the Magnificent Seven today represent a massive share of the overall stock market. That’s a potential source of concern, as investors today have record levels of household assets invested in equities—and those with passive or benchmark-oriented strategies are heavily exposed to a relatively homogeneous and expensive handful of companies.

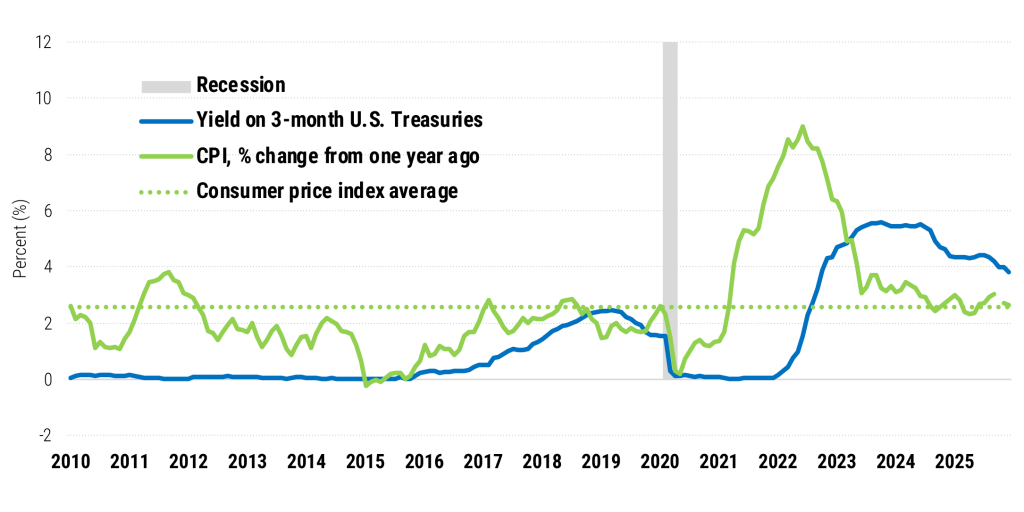

The post-COVID environment presents new challenges and opportunities

Higher and more persistent rates of inflation, an end to the near-zero interest rate regime, and more meaningful cost of capital all represent challenges for businesses. But they also create opportunities for long/short strategies: first, by creating an environment more likely to result in disparate outcomes for individual equities and second, by offering a more meaningful source of returns for short sale proceeds in the form of higher Treasury yields.

Source: Federal Reserve Bank of St. Louis, U.S. Bureau of Labor Statistics, as of January 1, 2026. No CPI figure was reported for October 2025 due to the federal government shutdown. See other important definitions below. Past performance does not guarantee future results.

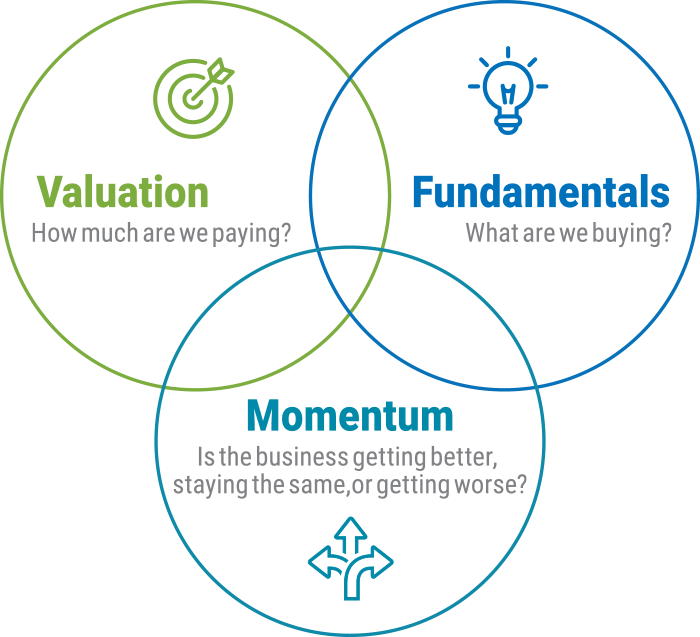

BOSTON PARTNERS THREE CIRCLE APPROACH

A single, time-tested approach

In our business, consistency is key. That’s why we apply a single investment philosophy to every portfolio we manage, regardless of geography or market capitalization. We call it our Three Circle approach, and our experience has shown that executing it in a repeatable fashion has led to superior results over time.

A depth of talent

Our investment division is not only well resourced, it’s also long-tenured. More than half our investment professionals have at least 20 years of industry experience and all our analysts—with an average of 10 years experience—perform short-sale research as a part of their coverage.

A highly experienced team

Boston Partners has been investing in the long/short space since 1997. Since then, we’ve successfully navigated three recessions, four bear markets, and more than a dozen stock market corrections and have consistently added value along the way. Few other firms have that level of hands-on experience in long/short investing.

Explore additional resources on long/short investing

How long/short investing can turn into a positive turblent markets

With volatility back in play and concentration risk still a major challenge, investors may want to consider making a long/short strategy a dedicated part of their portfolios.

Long/short investing at Boston Partners

Take a deeper dive into Boston Partners’ suite of long/short offerings and see how they can help dampen volatility in the markets like today’s.

Boston Partners Long/Short Equity strategy profile

Explore the long-term track record behind the strategy, its risk profile, and history of outperformance in challenging markets.

Quarterly factsheets

For more information on any of our long/short strategies or how they can work in a portfolio, contact us.

Important disclosures

An investment in a long/short strategy involves unique risks, including the risks associated with short-selling, which can lead to potentially unlimited losses. The strategy may also use leverage, which can amplify both gains and losses.

Important definitions:

Alpha measures the excess risk-adjusted return of a portfolio relative to a benchmark index. The S&P 500 Index tracks the performance of the 500 largest companies traded in the United States. The S&P 500 Equal Weight Index also tracks the performance of the 500 largest companies traded in the United States, but weights each company equally, rather than proportionally according to market cap. The Magnificent Seven stocks are a group of high-performing and influential companies in the U.S. stock market: Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA, and Tesla. It is not possible to invest directly in an index.

Diversification does not assure a profit or protect against loss

7993598.2